Losing your parents can be heartbreaking. When selling a home you’ve inherited from your parents, you’ll have a long list of items that require attention. During this difficult process, it’s easy for details to get overlooked. This guide will help shed light on the path forward.

Inheritance Tax

Once you learn that you’re inheriting property, you’re likely wondering if you are obligated to pay an inheritance tax on property. Fortunately, the act of inheriting a property doesn’t trigger any automatic tax liability. What you decide to do with the property moving forward, will affect your tax liability.

Capital Gains Tax

Capital gains taxes are taxes you pay to the federal government based on profits you earn from the sale of an investment. For example, capital gains taxes are paid on the difference between what you originally purchased a property for and what you sell it for.

Step-up Tax Bases

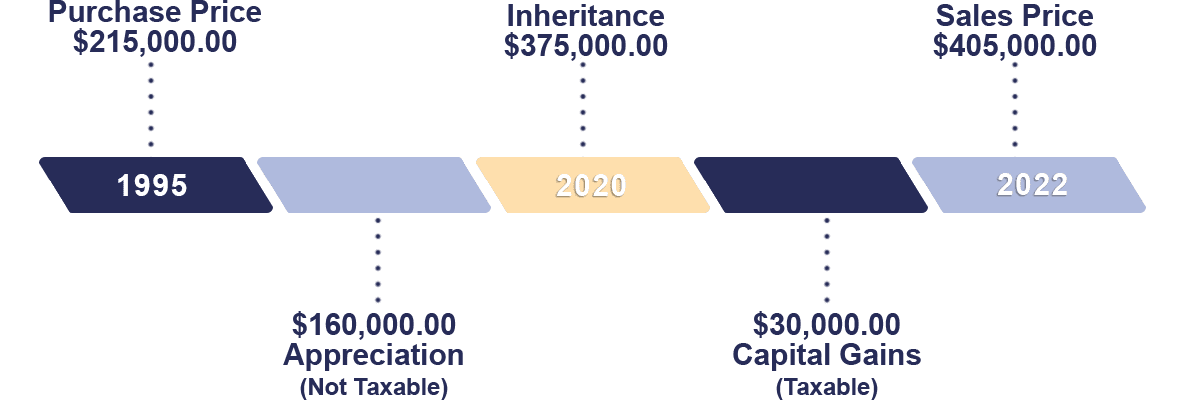

As the recipient of an inherited property, you’ll benefit from a step-up tax basis, meaning you’ll inherit the home at the fair market value and be taxed on any appreciation between the time you inherit the home and when you sell it.

For example, let’s say a house you inherit is owned free and clear and was originally purchased in 1995 for $215,000. The house is now valued at $375,000. When you sell the property, you will not be taxed on the $160,000 in appreciation between 1995 and the date of your inheritance, you’ll only be taxed on appreciation from the date you inherit the property to a time when you may choose to sell.

I just inherited a property. What’s next?

Probate

Wait for the estate to go through probate. After the title is transferred to you through probate, you become the new legal owner and can dispose of the property as you wish.

Executor | Administrator

The executor is the individual who is responsible for paying off outstanding debts and final expenses before distributing property according to the wishes of the deceased.

If the property is in a Trust, the trustee holds this same power.

In situations where no executor is named in a will, one person is often designated by the court as the administrator and responsible to handle the disposition of real estate.

Decide what to do with the property

What you decide to do with your inheritance may be affected by the location of the property, its financial status and physical condition. A good first step is to order a title report to determine if there are any liens on the property.

Is there a mortgage on the property?

If there is an outstanding mortgage on the home you’ve inherited, this will likely affect your decision to sell or rent the property.

Due-on-Sale Clause

Federal law states that any mortgage will remain in effect when it passes from one person to another through inheritance. This negates the due-on-sale clause, meaning banks will not demand the full payment of the loan’s outstanding balance before transferring the property.

You can assume the existing financing or you may choose to refinance the mortgage.

Reverse Mortgage

A popular product with older homeowners looking to access their home’s equity without moving is called a reverse mortgage. In a reverse mortgage, the owner receives a regular cash payment in exchange for equity in the home. Upon death, the beneficiary often has a limited time to repay the amount due, usually six months. If a reverse mortgage is in place, you’ll be required to pay the balance in the allotted time. If you don’t have cash in hand to cover this expense, this will likely affect your decision on how best to move forward. You might choose to sell the home to pay the loan with proceeds from the sale or refinance the property to cash out available equity, cover the loan balance and assume a new monthly payment in your name.

Underwater Property

If the property you’re inheriting is underwater (meaning the outstanding debt is greater than the current value of the property), the issuing bank may agree to let you do a short sale on the home, accepting less for the property than the remaining loan amount.

Free and Clear

While the person leaving the home to you may have had a mortgage on the property, it is possible that the mortgage will be paid off by their estate, leaving you a home that is owned free and clear of any outstanding debt.

Home Inspection

If the home was occupied by an elderly loved one who was unable to keep up with regular home maintenance, the property you’ve inherited may require a little TLC. A home inspection is a great way to receive a comprehensive report on the properties current condition. Home inspections typically cost between $250.00 – $700.00, depending on the size of the home.

Cash Sale “As-Is”

Depending on the severity of repairs needed it may be beneficial to sell the property “as-is”. Selling for cash allows for a quick sale without the added expense and hassle of preparing the home for a traditional sale.

Keep in mind, depending on the severity of the repairs needed, preparing a home for market could take 3 – 6 months. During this time mortgage payments, utilities and any tax liability will continue to accrue on top of the added expense for the renovations.

Traditional Sale

If you’re interested and able to get top dollar for the property and want to sell the property at market value, consider partnering with Improvio, a company based in Columbus, Ohio that provides high-impact, turnkey repairs and renovations and defers payment until the home is sold.

Multiple Beneficiaries

It’s very common to inherit partial interests in a property split between multiple family members. While many moving parts increase the complexity of making decisions, be sure to consider all your options:

Sell and split the proceeds:

Perhaps the most straightforward option, you agree to sell the home, pocketing your portion of the proceeds after expenses and commissions.

Rent and split the proceeds:

If the real estate market isn’t a sellers’ market, you may decide it makes more sense to rent the property. Hire a property manager and agree to divide the monthly cash flow after setting aside reserves for maintenance and vacancy.

Buyout:

If one heir wants to keep the home and other would like to sell, buy out the interests of those who prefer to sell. You can refinance the property with a loan that will return up to 75% of the home’s value and use these proceeds to cash out beneficiaries who are not interested in maintaining ownership of the property. You can pay cash out of pocket to buyout heirs who want to sell or you can obtain financing with heir loans from a reputable lender.

Promissory note:

If one heir wants to keep the home and other would like to sell, and you don’t have access to a mortgage, record a promissory note that outlines how you’ll pay their portion of the inheritance in monthly installments. While many heirs may not be interested in waiting to receive their inheritance, you may be able to sweeten the deal by adding interest to the debt to be paid in time.

Suit for Partition:

If heirs do not agree on what to do with a property, file suit for partition. By filing a suit for partition, you are asking the court to order the sale of the home. This can be a timely and expensive process, with legal fees that will cut into your profit. After considering expenses, you may be better off choosing to sell before involving the court.

In Conclusion

Selling a home you’ve inherited from a loved one who has passed takes careful consideration. The added stress that comes with selling any property during an emotional time can easily send a calm, cool, and collected person over the edge. Be sure to keep this in mind moving forward and maintain graciousness with yourself and everyone involved.

If you decide to sell your property, take the time to research the costs so you can be prepared. Most realtors will do an excellent job sharing these expenses with a client prior to entering a contract to list the property. For more information regarding costs associated with selling a home, check out “How to Calculate Net Proceeds from a Home Sale.”

If you prefer to avoid the expense of listing your property, we would love to purchase your home today “as-is”. Find out how much you can save on closing costs and other home-selling expenses with a free quote.