What is Probate?

When a deceased leaves behind assets to be distributed to heirs, the legal process whereby this happens is known as probate. The cumulative assets are often referred to as “the estate” and may include bank accounts, real estate, jewelry and a wide variety of investments.

Typically, a will names an executor, or in the absence of a will, an administrator, to handle the probate procedure. After settling any outstanding debts related to the deceased’s estate, the remaining assets must be distributed to the beneficiaries.

Note

The legal procedure known as probate is used to examine a deceased person’s belongings and identify heirs.

Probate proceedings usually center on determining if a will exists and whether it is legitimate.

Probate can be initiated with or without a will.

Even in cases where a will exists, probate is necessary when the deceased person’s remaining estate is significant.

Having an easily verified will or employing investment vehicles that do not require probate are two ways that people might avoid the enormous fees and complications associated with probate.

The Operation of Probate

Upon death, a probate court will determine if the deceased left a valid will. After determining if a valid will exsists, courts will examine the assets of the deceased property owner. The final steps during the probate procedure involve the allocation of assets to beneficiaries.

Execute a Will

A testator is a deceased individual who left a will. The executor is in charge of starting the probate procedure when the testator passes away. The executor is usually a member of the family and they’re usually designated in the will.

The will must be submitted to the probate court by the executor. The amount of time after death within which a will must be filed varies by state. Probate begins when the will is filed. During the court-supervised probate process, the validity and authenticity of the bequeathed will are established and acknowledged as the genuine final testament of the departed. The executor designated in the will is formally appointed by the court, granting the executor the authority to act on behalf of the deceased.

The Executor is in charge of finding and managing all of the deceased persons assets. Section 26 U.S. Code § 1014 of the Internal Revenue Code provides that the executor will value the estate at the time of death.

Most assets that are subject to probate administration come under the supervision of the probate court in the place where the decedent lived at death. Real estate is an exception. Probate proceedings are liable to the laws where it is situated.

For information regarding probate in Franklin Co Ohio, check out “Inheritance Law in Ohio.”

Taxes

Taxes and other debts owing by the deceased must also be settled by the executor out of the inheritance. Creditors normally have a limited length of time (roughly one year) from the date of death to lodge any claims against the estate for money owed to them. If the executor rejects a claim, it may be brought before a probate judge, who will make the final determination as to whether the claim is warranted.

The executor is also in charge of submitting the deceased person’s last personal income tax filings. In addition, any unpaid estate taxes may become due one year after the date of death. The executor will request permission from the court to disburse any remaining estate funds to the beneficiaries following the taking of the estate inventory, the computation of asset values, and the settlement of any outstanding debts.

Insolvency

A deceased person’s administrator is likely to decide against starting probate if the estate is insolvent, meaning that debts exceed assets. Generally speaking, each state may have its own statute of limitations for the probate processing of a will.

Avoiding Probate

Trust funds can be set up such that, in the event of a death, assets transfer to beneficiaries seamlessly and avoid probate altogether.

Execute Without a Testament

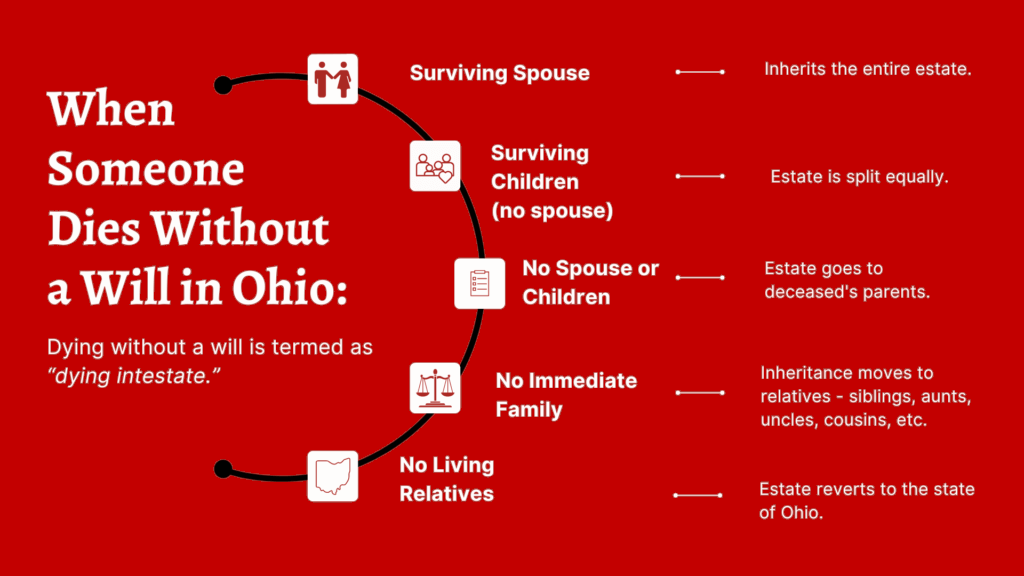

A person is referred to as having died intestate when they pass away without a will. An intestate estate is one in which the court-presented will has been declared void. Distributing the decedent’s assets in accordance with state law is a part of the probate process for an intestate estate. Below is a diagram of the laws of succession in Ohio.

Generally, the appointment of an administrator to manage the decedent’s estate marks the start of a probate court procedure. As an executor, the administrator accepts all claims made against the estate and settles any remaining debts.

The administrator is responsible for tracking down the deceased’s legal heirs, who may include living parents, children, and spouses. The probate court will determine how and what assets must be divided among the legitimate heirs. Most states’ probate rules allocate assets to the deceased person’s surviving spouse and children. If you can use additional information or an experienced probate attorney in Ohio be sure to check out Heban, Murphree & Lewandowski.

Couples as Co-Owners of Property

In an intestate procedure, both spouses may be recognized as joint property owners under community property laws. Essentially, the surviving spouse is usually at the top of the distribution system. When a person passes away, their assets are often split among their remaining children whether they were single or widowed. Other relatives may also be regarded suitable for distribution after a spouse and children have been taken into consideration.

Under most state probate statutes for intestate estates, close friends of the deceased will not be included on the list of beneficiaries. However, the surviving friend/partner would automatically hold the joint asset if the dead had a joint account with right of survivorship.

Escheatment

Any assets left over after a person dies without a will or heirs pass to the state.

Assets transferred to the government is known as escheatment. States do usually offer a window of opportunity within which an heir wishing to come forward can claim any assets.

Does Every Death Need Probate?

Finding out if a probate is necessary after someone passes away is crucial. The completion of the probate process can be lengthy. The lengthier it takes to settle and divide the assets, the more complicated or contentious the estate. Cost’s increase with the length of time.

It usually costs more to probate an estate without a will than one with a valid will.

Avoiding probate would also guarantee that all settlements be conducted quietly because the records of a probate court’s proceedings are open to the public.

The rules governing probate and whether it’s necessary following a testator’s death vary state by state. Certain states have an estate value threshold that must be met through probate. For instance, Texas’s probate laws allow for the omission of the probate process if the estate is valued at less than $75,000.

Alternative legal proceedings, such as an affidavit, may be used to claim an estate’s asset if it is modest enough to avoid the probate process. Generally speaking, alternative measures may be adopted and probate is not always required if a deceased person’s debts outweigh their assets.

Certain assets are exempt from probate because beneficiaries have been designated by contract. Probate is not required for pension plans, life insurance payouts, 401(k) plans, medical savings accounts, or individual retirement accounts (IRAs) with named beneficiaries. Similarly, assets held jointly and subject to a right of survivorship are exempt from the probate procedure.

As mentioned before, a trust is a common method to completely bypass the need for probate.

Estate planning can be a wise way to keep the expenditures of the probate process to a minimum. Court fees, hours of professional services, and administrative expenditures add up quickly and must be paid from the estate. One of the most popular strategies to expedite the probate procedure and effectively distribute assets is to have an easily validated will.

For more information regarding selling a home that’s in probate, check out “Selling an Inherited Home in Ohio.”

In Closing

If you’ve recently inherited a home and would like to sell the property, CoreMark Homes may be an excellent buyer for you. We would love to purchase your home “as-is”. Find out how much you can save on closing costs and other home-selling expenses with a free quote.