Does Ohio Have an Inheritance Tax or Estate Tax?

Ohio is a hands-off state with no estate or inheritance taxes. This applies to both in-state residents and nonresidents who simply own property in the Buckeye State.

While many are happy to hear that Ohio has no estate or inheritance taxes, that doesn’t mean you’re not liable for any expenses in the name of either the decedent or his or her estate. It’s always best to explore legal matters with an experienced attorney, however, tax liabilities may include:

Federal and state income tax returns – due by tax day of the year following death

Federal estate / trust income tax return – due by April 15 of the year following death

Federal estate tax return – This is required only of estates that exceed $11.4 million in gross assets and is due nine months after death.

While we won’t be dishing out tax advice, we’re an excellent resource for selling an inherited property. Check out our article on selling an inherited house quickly, with no fuss.

Dying Testate | With a Will

When someone pass’ with a valid will, there aren’t many laws that are required to govern inheritances.

A testate will is one that meets the following requirements:

The will is typed or written by hand

The will is signed by the decedent and no fewer than two witnesses

Besides heirs, an estate is executor is named

The executor is an integral part of any will. This individual is responsible for paying off outstanding debts and final expenses before distributing property according to the wishes of the deceased.

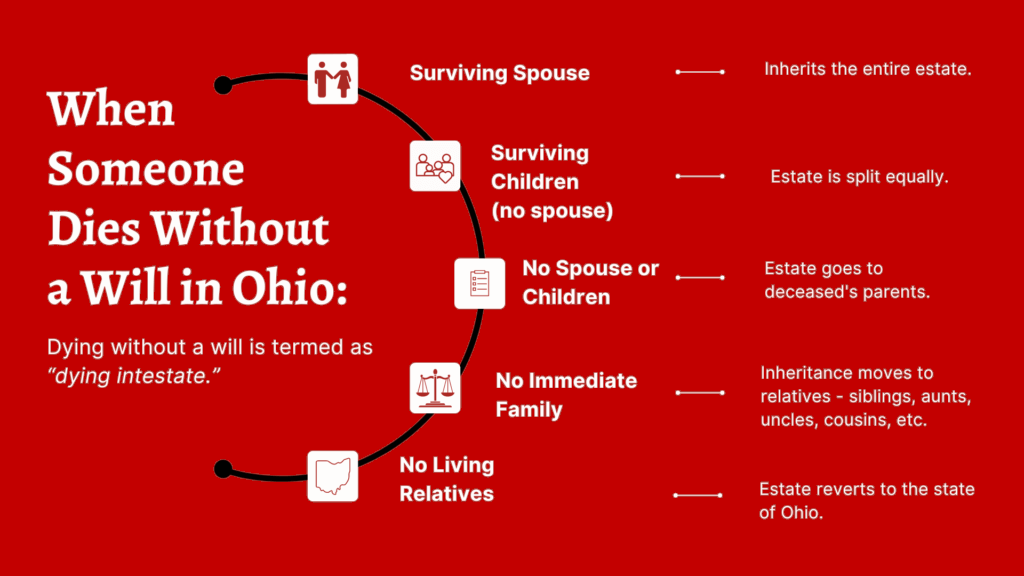

Dying Intestate | Without a Will

Intestate, describes an estate or individual who has died without a valid will. Fortunately, in these circumstances, the state has adopted intestate succession statutes that help distribute assets between survivors.

In these circumstances, property is divided into: real property and personal property

Real property is land, a home or anything else that’s affixed to the ground.

Personal property is everything else someone might own, like a car, furniture, valuables and family heirlooms

An executor must be assigned to handle an estate since there’s no will that explicitly names one. A probate court will usually choose someone who was close with the decedent or his or her family to act in this capacity.

The Probate Process

Probate is the system by which the courts overlook an estate to ensure a will is executed according to the wishes of the deceased or implement intestate succession laws if there isn’t a will.

While most estates will enter probate, there’s a few exemptions:

The estate’s worth less than $45,000 and the surviving spouse is the sole heir

The estate’s worth less than $5,000 and/or the decedent’s final expenses total no more than $5,000

Spouses

The surviving spouse receives 100% of the decedent’s estate if no children are present or all of their children were with each other. Other than these two scenarios, a surviving spouse will inherit more or less of an estate depends on who the children’s parents are.

Decedents who had one child outside of his or her marriage with the surviving spouse are entitled to the first $20,000 of the estate, and half of whatever’s left over.

If more than one of the decedent’s children were with another partner, and the spouse isn’t a legal parent to any of them, the spouse is given the first $20,000 of the estate, plus one-third of the balance. However, should the surviving spouse claim parenthood to at least one of the decedent’s children, his or her share will rise to the first $60,000 of the estate, plus one-third of the balance.

Here’s a simple diagram to shed some light on the complex process of intestate succession:

Intestate Succession | Children

Unmarried decedents who have surviving children will have their estate divided evenly between surviving children, leaving each child with the same value.

If a person was married when he or she died intestate, how much their children inherit depends on whom the child was born to.

If one child of the decedent has a parent other than the surviving spouse, the children split the remaining proceeds after the spouse is paid.

When more than one child is from another relationship, the share of the spouse is slightly altered, and all children are again left with the balance. Here’s a breakdown of how this looks:

Intestate Succession | Spouses & Children

| If spouse, but no children | Entire estate to spouse |

| If spouse, and children only from spouse and decedent | Entire estate to spouse |

| If spouse, and one child from decedent and a person other than surviving spouse | First $20,000 of estate to spouse – Leftover split evenly among children |

| If spouse is not the adoptive or biological parent of any of the children | First $20,000 of estate to spouse – 1/3 of the estate’s balance to spouse |

| If spouse is the adoptive or biological parent of at least one of the children | First $60,000 of estate to spouse – 1/3 of the estate’s balance to spouse |

| In both cases, leftover split evenly among children | If children, but no spouse – Estate split evenly among children |

The state of Ohio automatically considers a child born to your wife as a child of your marriage or domestic partnership. Children born outside of your marriage are only given rights to your intestate estate if your paternity is legally established:

A paternity test proves you are related

You legally adopt the child

You marry the mother after the child’s born

A legally adopted child receives the same size share of his or her parent’s intestate estate as any biological children. Children of the decedent born following a death are also considered full-fledged children under the law.

Grandchildren become valid heirs if, and only if, their parent (the decedent’s child) is passed.

Stepchildren in Ohio are not entitled to any part of their stepparent’s intestate estate. But if a decedent leaves surviving stepchildren and no spouse or relatives, they become legal intestate heirs.

The same does not apply to foster children. If you put your child up for adoption, he or she is not considered an heir to your estate.

Intestate Succession | Unmarried No Children

| If parents, but no spouse or children | Entire estate to parents |

| If no parents | Estate split evenly among siblings |

| If no siblings | Estate split evenly among paternal/maternal grandparents |

| If no grandparents | Estate split evenly among paternal/maternal aunts and uncles |

| If no aunts and uncles | Estate split evenly among paternal/maternal cousins |

| If no cousins | Entire estate to nearest relative(s) |

| If no more relatives | Estate split evenly among stepchildren |

| If no stepchildren | Estate split evenly among children of stepchildren |

If after all this searching, no viable heirs is found for your estate’s property, it will be granted to the state. Specifically, the estate will be offered to the school district in the county where the decedent resided or owned property.

Non-Probate Inheritance

Should the testate or intestate estate of a decedent need to go through probate, there are a few types of assets that will not be included in the proceedings:

Property in a revocable trust

Joint-tenancy real estate

Beneficiary payouts for life insurance

IRAs, 401(k)s and other retirement accounts

Payable-on-death accounts

In Closing

If you’ve recently inherited a home, condolences on your loss. If you would like to sell the property, CoreMark Homes may be an excellent buyer for you. We would love to purchase your home “as-is”. Find out how much you can save on closing costs and other home-selling expenses with a free quote.