Much to everyone’s dismay, the sales price of your property is not the amount of money you actually walk away with, cash in hand. Net proceeds are the total dollar amount a seller will pocket from the sale of a house after accounting for all expenses, holding costs, commissions and fees incurred during the sales process. If you’re considering selling your home, this easy-to-follow guide will help you estimate how much money you’ll actually make from the sale of your home.

Start with an estimate

A good first step is to formulate an estimate of how much your property is worth. This shouldn’t be “wishful thinking” or your best guess. Instead, you need a reasonably informed estimate using data.

How do you come up with a proper estimate?

Check local home real estate sites like Zillow and Redfin for comparable home sales in your area.

What exactly makes a comparable sale?

- Sold within the past 6 months

- Is similar in square footage +/- 150 sq feet

- Same number of bedrooms / baths

- Built around the same time as your property +/- 10 years

- Within ½ mile of your property

- Similar condition

If a recently-sold home is in similar condition, with similar square footage, has a similar level of upgrades (or lack of upgrades), and is in your neighborhood, the sale price of that home is an ideal comp. If you can find multiple homes that fit these criteria, even better.

Pay special attention to the date of the sale. The housing market is in constant flux and just because a comparable home sold for a certain price last year, doesn’t mean your house will sell for that price today. Try to find comparable sales from the past three – six months to get the best estimate or your home’s value.

If you find this analysis and valuation to be tedious or beyond your skillset, Realtors are usually happy to offer a Competitive Market Analysis (CMA) that will include this information at no cost.

Seller concessions

After arriving at a solid understanding of your homes value, start tallying up expenses that will subtract from the sale price.

First, calculate any potential seller concessions. A seller concession is a “gift” from you, the seller, to the estate at the bequest of the buyer. Concessions include repairs and renovations to the property or price reductions for any repairs found during an inspection that the buyer deems necessary.

Common seller concessions include:

- Grounding ungrounded outlets

- Plumbing problems

- Termite damage

- Roof needing replacement

- Code violations

- Foundation repairs

If you have no idea of possible concessions that may come up during inspection, nor the cost to cover these items, a good baseline seller concession is 1.5% of the purchase price. This cost may vary widely depending on the condition of the property.

Transaction costs

They say nothing in this life is free, and that is certainly true when selling your home. It is difficult to sell a home on the traditional real estate market without the services of a licensed real estate agent. Agents are not cheap. The typical real estate commission fee amounts to 6% of the sale price.

Beyond agent commissions, as the seller, you will likely be responsible for paying closing costs to title and escrow companies. Closing costs are all the administrative costs in a home transaction such as fees for attorneys, a title search, title insurance, taxes, and lender charges. These fees add up fast and often reach an additional 2 – 3 % percent of the home sale.

Transaction costs, including Realtor commissions, typically amount to 7 – 9 % percent of the sale price.

Holding costs

Just because you put your home on the market doesn’t mean you have a “get out of mortgage free” card. On the contrary, plan to cover the expense of the mortgage and other typical housing expenses for the entire time your house is on the market. Your home may sit on the market for a while, especially if repairs are needed, so you’ll need to estimate what it will cost during that span.

According to data from the National Association of Realtors, the average home, spends between 65 and 93 days on the market.

Beyond the mortgage, you’ll be sure to factor in monthly expenses like utilities and HOA fees. Collectively, all of these costs are known as “holding costs.”

If you’re unable to precisely calculate holding costs based on your known expenses, a good benchmark estimate is 0.7% of the total home value per month.

Calculate total proceeds

Based on the information compiled in the previous steps, you can now begin to calculate your home sale net proceeds. Keep in mind, however, that the amounts can change based on the condition of your property and current market conditions.

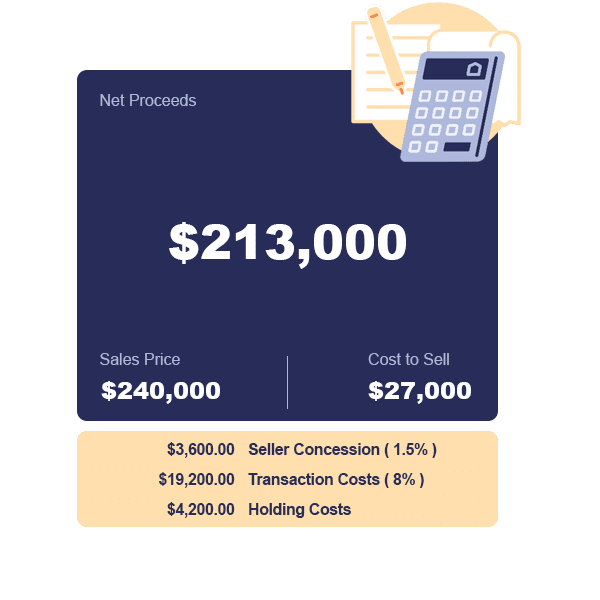

Let’s take a look at the example below for a house with an estimated value of $240,000.00:

Don’t forget mortgage and soft costs

In the example above, we can see the net proceeds from a property that sold for $240,000 amounts to $213,000. This estimate does not factor in any outstanding mortgage, liens or other debts.

While these calculations can help you estimate the dollars and cents involved in a home sale, they don’t begin to account for the “soft costs” associated with selling a home. Soft costs include:

- Keeping the house clean

- Having the home staged

- Adjusting your schedule to accommodate showings

- Negotiating with potential buyers

For homeowners who value convenience, the hassle of listing a property on the market and navigating a traditional sale may offset additional earnings. When considering the best path forward for your situation, there’s plenty to think about. Remember, when forecasting probable financial outcomes, be sure to use net proceeds.

For additional information regarding hidden costs that may be associated with selling a home on the market, be sure to check out “8 Hidden Costs When Selling Your Home”

Net Proceeds Calculator

For convenience, we’ve compiled all of the information in this article into a Net Proceeds Calculator.

What’s the alternative?

If you decide the sales process is arduous, time-consuming or too expensive, you’ll be happy to learn that there are alternatives to the conventional sales route. Many choose to sell their homes for cash or terms to an off-market buyer. Selling a home off market means the home is never listed on the MLS and is instead purchased directly by an individual or business. An off-market sale is not only faster and easier, it may be an excellent fit for your circumstances.

Contact CoreMark today to receive a no-obligation cash offer.