Selling your home is a big decision. It can feel like a giant mountain of a task, and you may have no idea where to start. Your worst nightmare is selling way below value and losing money.

What’s the right price?

That is the question.

If you don’t know how to determine your home’s value, you’re not alone. You’d be surprised at how many homeowners are absolutely clueless about what their home is truly worth.

Here’s how to educate yourself about your home’s value.

3 Steps to Learn Your Home’s Value

When you know the facts, you make better decisions. It’s plain and simple. Here are three easy steps that will help you understand your home’s market value.

Step 1: Know What “Home Market Value” Means

Believe it or not, your home’s market value is not based on the following:

- Your monthly mortgage payment

- Your opinion of how great your home is

- Your memories

In a nutshell, market value is what buyers are willing to pay for your home.

An expert agent is going to be your best bet in helping to determine the market value of your home.

As a homeowner, it’s tough to see your home the way a buyer might. Although you think little Chris’s handprints in the front porch pavement are cute, a potential buyer will see them as just one more thing to fix. Keep in mind that a serious buyer will take note of the following:

- Location: How close is your home to highways, schools and shopping centers?

- Safety: Does your neighborhood have sidewalks, underground electrical lines and a low crime rate?

- Curb appeal: Is your house ugly? Or is it beautiful?

- Square footage: How big is your home? Is the layout weird?

- Number of rooms: Does the ratio of bathrooms to bedrooms make sense?

- Updated appliances: Will these items need to be replaced?

- School district: How are the schools rated in your area? Are there multiple options?

Some factors affecting your home’s market value are out of your control. For instance, if the economy is tanking, buyers will be hesitant to pay top dollar for a house. The final price tag may also depend on:

- Mortgage interest rates: A mortgage is a huge financial commitment. High interest rates will keep some buyers from pulling the trigger.

- Time of year: Homes sell better during certain months than they do in others. For example, most buyers won’t choose to move during the middle of the holiday season or at the beginning of the school year. Expect to get more or fewer offers depending on the time of year.

- Supply and demand: If there are a ton of houses on the market, that means you’ve got competition. On the other hand, if there are more interested buyers than there are “For Sale” signs, raise your price!

- Comparable properties: How much are people willing to pay for a home like yours in your neighborhood?

If you’re trying to sell your home, an expert real estate agent can help you make sense of all this information to create an ideal listing price.

Step 2: Use Free Online Tools to Estimate the Value of Your Home

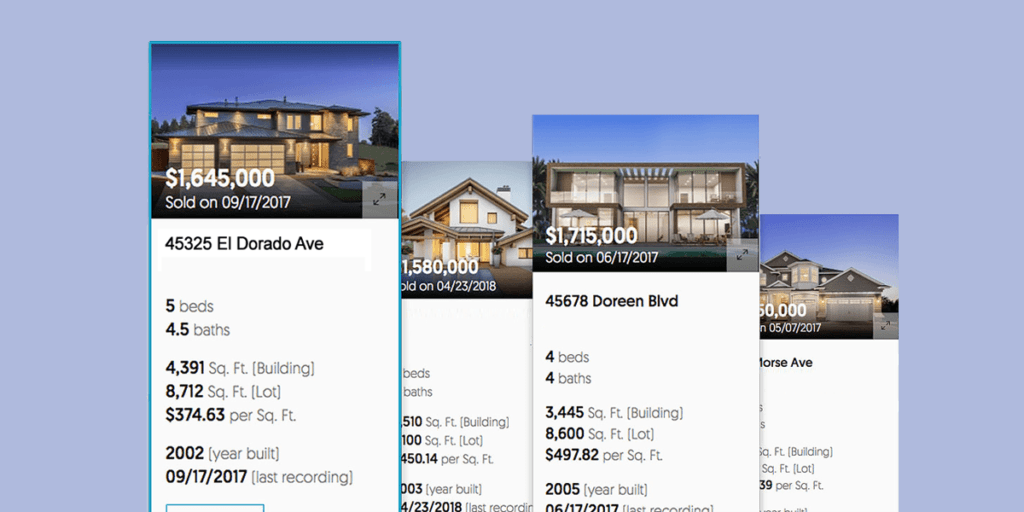

If you search for your address on an online real estate marketplace, you’ll likely find all kinds of facts about your home that are public record, including:

- Type of home

- Year the home was built

- Number of bedrooms and bathrooms

- Square footage

- Square footage of the lot

- Heating and cooling systems

- Number of parking spots

- How much you and each previous owner paid for the home

Along with these items, you’ll often see an estimated market value.

Online tools put this number together by looking at the sales of homes in the area that are similar to yours, local tax assessments, and whether homes in your area are increasing or decreasing in value over time.

Before you get too excited about this number and slap a price on your house, it’s important to dig a little more. While these online estimates are helpful, they’re not always accurate. The estimates are only as reliable as the amount of public record data the real estate websites can access. The less data gathered for your particular neighborhood, county and state, the less you can depend on this number.

As a home seller, the real value you’ll get from these sites comes from the information you find about your housing market. Scroll through the data and see if you can answer any of these questions:

- Is my home value trending upward or downward?

- How does my home value compare to other homes in my neighborhood?

- How does my home value compare to those in other zip codes in my area?

- How long are properties sitting on the market before they sell?

That’s useful information you can discuss with your real estate agent when it comes time to set a price for your home.

Step 3: Consult an Expert

If you’re interested in selling your home, it may be prudent to contact an agent, no matter what you find online. Your agent can offer a world of information to help you make better decisions about selling your home.

A real estate agent isn’t stale information on a shelf. Unlike online tools, real estate agents have access to a multiple listing service (MLS) database of homes for sale in the area and key insights regarding unique features of your home that will allow them to run an accurate comparative market analysis (CMA).

A good real estate agent will take the time to come and look at your home. They’ll consider the landscaping, the condition of the house, upgrades you’ve added and all those things that aren’t listed in public records but make a real difference to potential home buyers.

Agents use the power of real-world experience to compare your home’s “je ne sais quoi” to recent sales and current listings.

Let’s say you installed a new roof last year but your kitchen’s straight ‘70s. An experienced agent knows how to weigh those factors and still come up with a competitive price. Remember, the market value is not based on formulas. It’s based on how much someone is actually willing to pay for your home.

No computer can determine that, and your success as a seller rides on it.

Price your home too high and buyers will pass. Price it too low and buyers may think something is wrong with the property and you could lose thousands of dollars. The right price gets you the most money in the least amount of time.