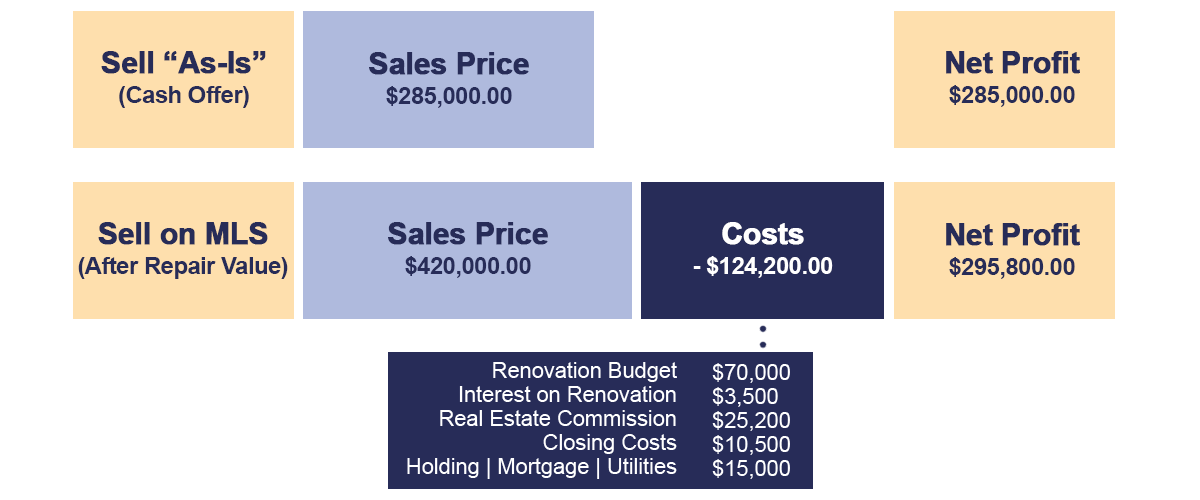

Compared to what properties sell for on the MLS, a cash offer for your house may appear low. MLS prices do not take into account repairs, closing costs, agent commissions, transaction fees, and holding costs incurred during the time it takes to sell a house on the market. Consider the following scenario, based on a typical off-market sale:

A home in a great area with minor foundation issues that hasn’t been updated in years may sell on the MLS for $420,000 assuming it receives a full remodel. The owner also has the option to sell that same house off market in as few as 10 days for $285,000. At a glance, the MLS price makes the off-market offer look ridiculous. Easy decision for the seller, right? Maybe not.

A conservative estimate to sell the house on the MLS would require:

After accounting for these expenses, the seller would net $295,800 after a six-month adventure, which comes with its own set of risks, stresses, and challenges. This is a lot for the seller to endure to pick up an extra $10,800.00 at closing. And that assumes everything goes smoothly.

The off-market cash offer may not make sense for every homeowner, but before deciding on what constitutes “fair”, sellers should always take into account the net proceeds from a home sale.

For more information on net proceeds from a traditional home sale, visit “How to Calculate Net Proceeds from a Home Sale.”

A great opportunity to generate a higher selling price in lieu of a cash offer is selling the home on terms, sometimes called “seller financing”. In this arrangement, sellers receive a significantly higher sales price and offset capital gains taxes by accepting an upfront cash payment from the buyer and a monthly payment over a period of time. Be sure to discuss your options with a representative if seller financing sounds right for you.